The advent of technological advancement in the healthcare industry has brought forth many changes. You can witness a steep rise in the need for the searches of home care in Frederick among the aging population in Maryland. This highlights the significant rise of LTCI, or long term care insurance there.

According to Genworth, about 7 out of 10 people require long term care in their lives. This varies on the basis of different factors, such as geographic location, level of care, and so on. The rising cost of home care seems to be a burden on many families. So, there is a need for financial safeguards.

The previous blog highlighted the basics of long term care insurance. In this blog, we will be learning how to make the most of your long term care benefits with home care in Frederick.

Increasing Cost of Home Care

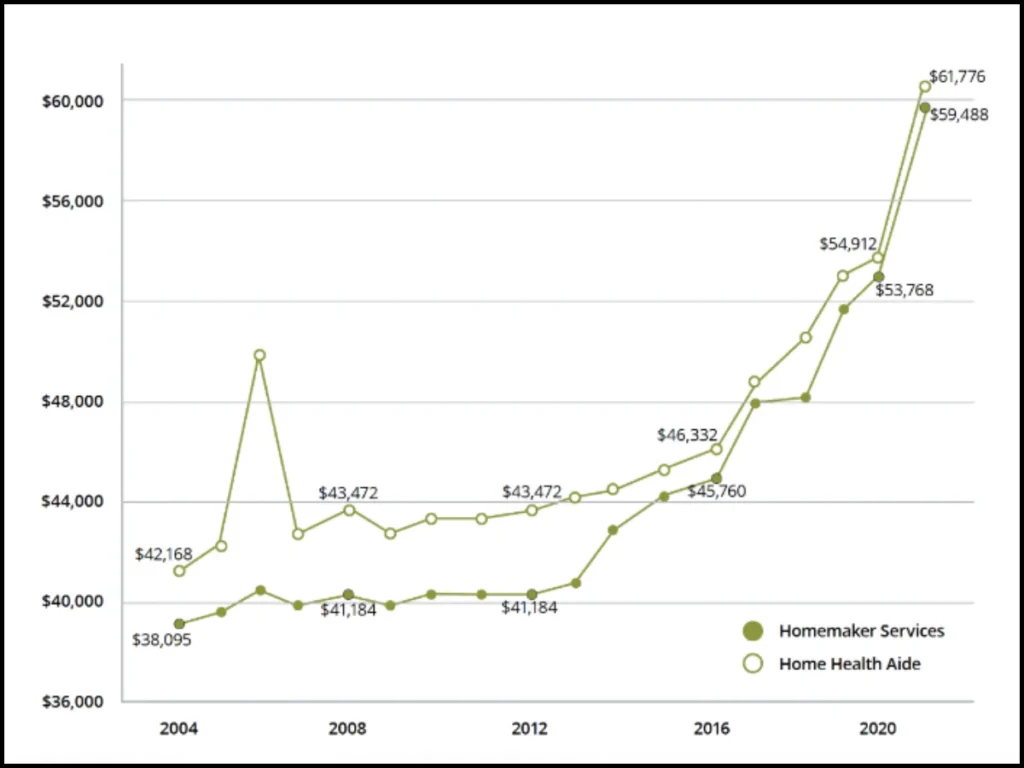

According to the Genworth survey, the cost of home care services in the USA has increased every year.

In the above graph, you can see the steep rise in homemaker services and home health aid.

For Homemaker services, the cost was $59,488 while for home health aide, the price rose to $61,776. However, the cost depends on the type of services and care needed.

For instance, the services for home care can be divided into two broad categories: the instrumental activities of daily living and the activities of daily living.

Instrumental Activities of Daily Living

It includes the tasks that allow an individual to live independently. For instance, meal-making, grocery shopping, household chores, and so on.

Activities of Daily Living

These include the tasks that help people stay fit and fine as they grow older. The range of services includes personal care, mobility, and much more.

Other sorts of home care services include housekeeping, personal care, dementia care, and so on.

If you have been a resident of Maryland, your home care cost depends on locations and services. From city to city and county to county, you can see the drastic difference in the price.

For instance, in Baltimore, MD, near Frederick County, MD, the price for homemaker services is roughly around $4,957 monthly. However, in Washington, DC, the area closer to Silver Spring, MD, the cost for homemaker services is roughly $5339 monthly.

Therefore, the staggering cost of home care services has largely affected the aging population to some extent. But you can avoid the rising cost only if you have a long term care insurance plan.

Understanding of Long Term Care Insurance

Let’s say you are in your golden years and your search for a ‘home care agency near me’ is on a constant rise. However, due to the increasing price, you always think twice before getting 24/7 home care.

But imagine what would happen if care insurance covered your home care services too? You do not have to think before looking for your perfect caregiver.

Long term care insurance (LTCI) includes a wide range of services to support an individual who is diagnosed with a chronic illness or other health problems. The wide range of services includes home care, which ensures that the loved one has the financial security to access the necessary care.

Paradigm Shift in Long Term Care Insurance

Traditionally, when we were speaking of long term care, it usually meant institutional care like assisted living or nursing home care. But today, most older individuals prefer to age in place.

And therefore, the rise of home care services in Frederick County comes into the picture. Having a personalized caregiver helps older adults enjoy the benefits of golden years. Especially for someone who is diagnosed with a chronic illness, it is important to learn about the benefits of trained caregivers.

Today, with the growing demand for home care services, long term care insurance costs the services of home care. So, if you are someone who already has an LTCI, it can cover the cost of your in-home care too.

In the following, we will explore briefly how home care in Frederick County, MD enhances the LTCI benefits for seniors.

Navigating Home Care Benefits in Frederick with LTCI

Long term care insurance (LTCI) costs include a wide range of home care services. So, you can cut down the cost of your home care services. For instance, the care advisors at Comfikare Homecare help you understand the complexities of insurance coverage so that you can avail the home care cost at a much lower price. As a result, you get customized home care benefits with LTCI.

Let’s understand the benefits one by one to get a comprehensive picture.

Personalized Care Plans Without Cutting Down the Assets

Having an in-home care service for loved ones helps older people to live independently. So, home care in Frederick works closely with families and their loved ones to develop customized care that aligns with the needs and preferences of loved ones. LTCI ensures that one is getting their specific needs met without having to cut down their assets.

Comprehensive Home Care Services at a Lower Price

We are all aware that home care services include various services. For instance, medication management, companion care, activities of daily living, and so on. LTCI, or Long term care insurance, covers various home care services at a much lesser cost. Therefore, it helps to cover the cost of certified and trained caregivers, health equipment, and other costs.

Promotes Aging in Place in Limited Financial Resources

In the advancing years, emotional well-being is as important as physical well-being. Home care services like companion care look after loved ones who need emotional assistance. So, one can stay at their own home and improve their emotional well-being too. We ensure that the LTCI benefits are fully utilized for home care services and promote aging in place. So, even when you have limited financial resources, you can afford home care services at its best.

Qualify for Various Healthcare Benefits like Medicaid

Many seniors find it challenging to understand the policy language of LTCI. As a result, most of them end up not fully utilizing its benefits. Having a home care advisor helps you understand the complexities so that you can get the maximum benefits out of LTCI and minimize the administrative challenges while getting the home care benefits. So, with LTCI plans, you can even qualify for Medicaid, a government program to pay for long term care.

In Conclusion,

As the need for home care services is constantly growing in the present scenario, it is important that seniors and their families be aware of the long term care insurance benefits. With the collaborative approach of home care agencies and families, you can navigate the challenges of long term care insurance (LTCI) policies and get the utmost benefits from them. Empower your loved ones with 24/7 homecare in Frederick and embrace the golden years with celebrated love and dignity.